E-Invoicing

Preparing Your Business

ZATCA Phase 1

ZATCA Phase 2

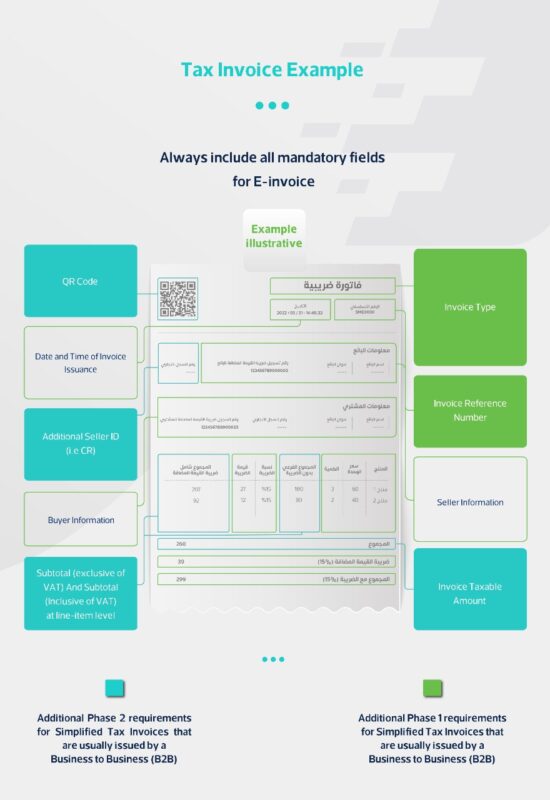

Simplify Tax Invoice

B to B

Tax Invoice

B to C

ZATCA Phase 1

For December 4th, 2021, taxpayers should:

1. Stop issuing manual invoices: handwritten invoices and invoices written using text editing tools are not considered e-invoices

2. Use a compliant electronic invoicing solution: e-invoicing solutions must comply with the requirements and specifications published under the e-invoicing laws and regulations and can be summarized for Phase 1 as follows:

- Ability to generate e-invoices with the required elements including QR codes

- Absence of prohibited functionalities:

- Uncontrolled access

- Tampering of e-invoices or logs

- Multiple invoice sequences

3. Ensure invoices include the required additional fields:

1. Tax Invoices (B2B): The VAT registration number of the buyer if the buyer is a registered VAT taxpayer in addition to the invoice type (description as a title). QR code can be added (Optional).

ZATCA Phase 2

In addition to Phase 1 requirements found here. for Phase 2 enforceable starting January 1st, 2023 in waves, taxpayers should:

1. User a compliant invoicing solution with phase two requirements:

- Ability to generate and store e-invoices in the required format (XML) or (PDF/A3 with embedded XML) with the required fields

- Ensure the e-invoicing solution is compliant with the e-invoicing requirements including the ability to connect to the internet

2. Integrate e-invoicing solution with ZATCA's Fatoora portal:

What is e-invoicing?

What is E-Invoicing (FATOORAH)?

Electronic invoicing is a procedure that aims to convert the issuing of paper invoices and notes into an electronic process that allows the exchange and processing of invoices, credit notes & debit notes in a structure electronic format between buyer and seller through an integrated electronic solution.

What is an electronic invoice?

A tax invoice that is generated in a structured electronic format through electronic means. A paper invoice that converted into an electronic format through coping, scanning, or any other method is not considered an electronic invoice.

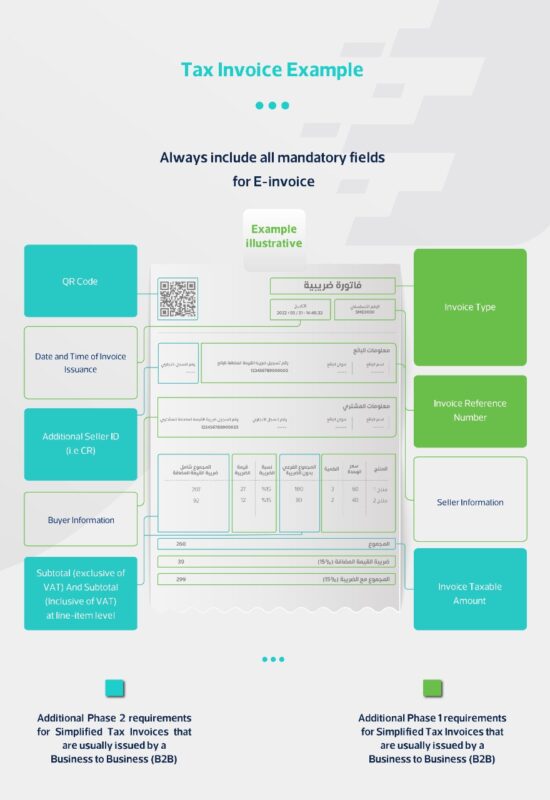

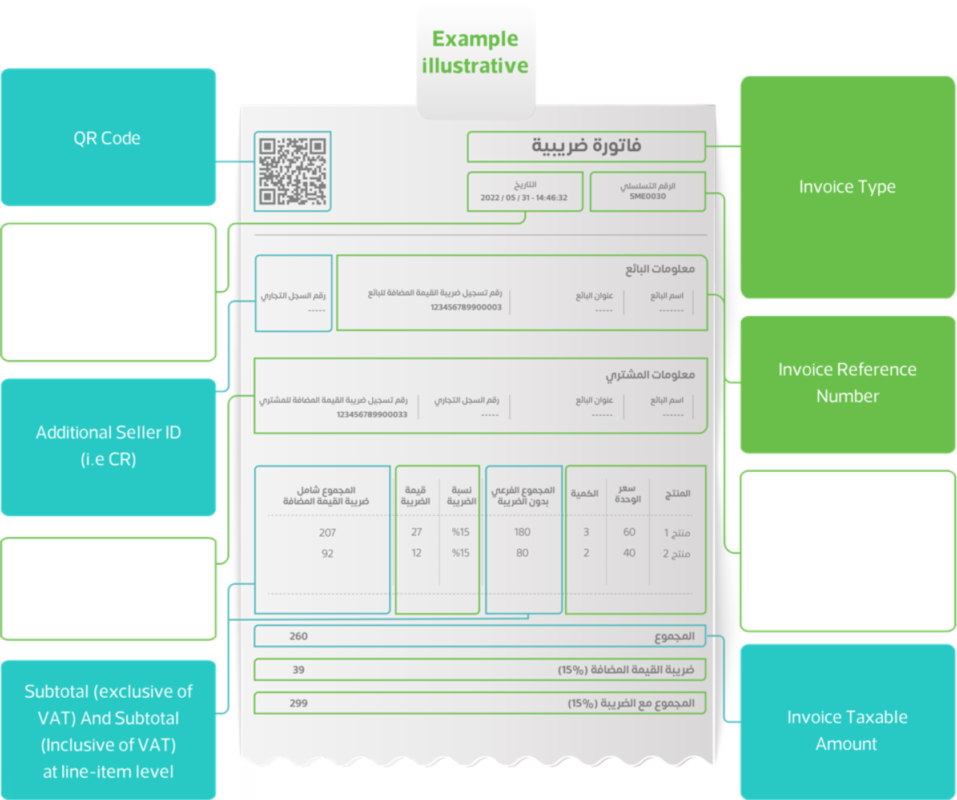

Tax Invoice

An invoice that is usually issued by a Business to another Business (B2B), containing all tax invoice elements.

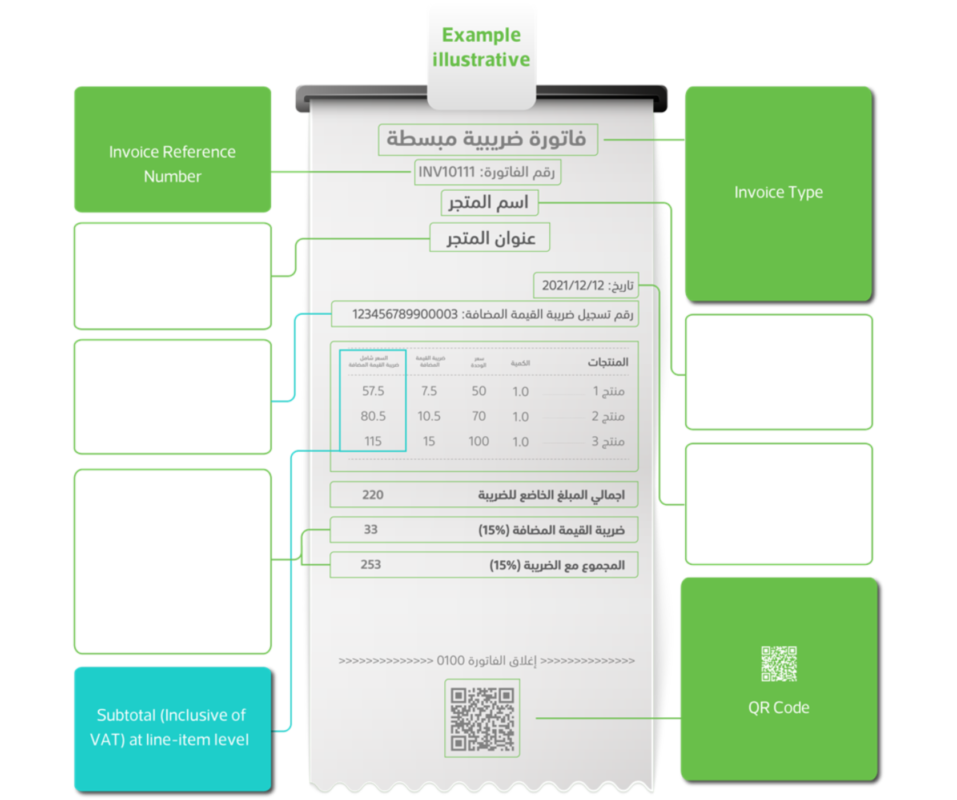

Simplified Tax Invoice

An invoice that is usually issued by a Business to consumer (B2C) containing all simplified tax invoice elements.

How does E-Invoicing (FATOORAH) work?

E-Invoicing will be rolled-out in two phases in KSA (more details about the phases here).

For the first phase, enforced as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT, electronic invoice issuance will be very similar to invoices generated prior to 4 Dec 2021, with invoices issued through a compliant electronic solution and including additional fields depending on the type of the transaction.

For the second phase, enforceable starting January 1st, 2023 in waves, the electronic solution must be integrated with ZATCA's systems and e-invoices should be generated in the required format.

What are the required fields for the e-invoice in phase one (generation phase) and phase two (integration phase)?